5 tips to help you raise funds for your early stage startup

Raising funds for early-stage startups requires a strategic approach. Start by developing a solid business plan that outlines your vision, target market, unique value proposition, and revenue model. Seek initial funding from personal savings or friends and family, while also exploring other potential sources such as grants or crowdfunding.

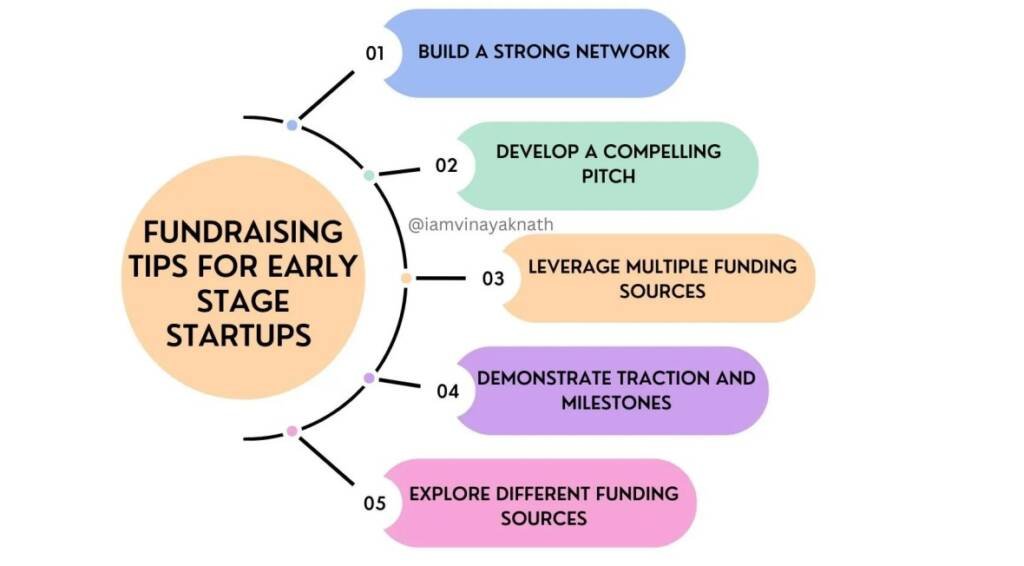

Here are the top 5 tips to raise funds for early-stage startups:

Refine Your Value Proposition

Clearly articulate the unique value proposition of your startup. Investors want to see a compelling reason why your product or service stands out in the market and has the potential to generate significant returns. Focus on what problem your startup solves, how it adds value to customers, and the competitive advantage you have over existing solutions.

Build a Strong Network

Networking is crucial for fundraising. Develop relationships with potential investors, mentors, industry experts, and fellow entrepreneurs. Attend startup events, join industry associations, and leverage online platforms to connect with the right people. A strong network can provide valuable introductions, advice, and opportunities for funding.

Prepare a Stellar Pitch Deck

Create a well-designed pitch deck that tells a compelling story about your startup. Clearly communicate your vision, market opportunity, business model, and growth strategy. Include data, market research, and key metrics to support your claims. Keep the pitch deck concise, visually appealing, and focused on the most important information that investors need to know.

Demonstrate Traction and Milestones

Investors are interested in seeing progress and traction. Show evidence of market validation, customer acquisition, revenue growth, and key milestones achieved. This could include metrics such as user engagement, revenue generated, partnerships formed, or product development milestones. The more evidence you can provide of your startup’s potential and progress, the more attractive it becomes to investors.

Explore Different Funding Sources

Don’t limit yourself to just one type of funding source. Explore various options such as angel investors, venture capital firms, crowdfunding platforms, government grants, and startup incubators/accelerators. Each funding source has its own requirements, advantages, and limitations, so diversify your options and tailor your approach accordingly.

Remember, raising funds for early-stage startups can be a challenging and time-consuming process. Be prepared to face rejections and learn from them. Continuously refine your pitch,

network diligently and be persistent in your efforts. Each investor interaction is an opportunity to learn and build relationships, even if funding is not secured immediately. Stay focused, believe in your vision, and persevere in your efforts to raise funds for your early-stage startup.

Tags

Startups In India, Fundraising, Networking, Funding, Mentoring

About the Author Vinayak Nath

• Co-Chair Alliances Task Force Startup20, G20

• Co-Chair, National Entrepreneurship Awards Govt of India

• Co-Chair, CITAR, CSIR-IITR, Govt. of India

• Mentor, DPIIT, Govt. of India

• National President, BSIS and Chair, International Council, BSIS

• Technocrat | Angel Investor | TEDx Speaker

“Infiltrators are principal vote bank of Mamata Banerjee”: HM Amit Shah

Lok Sabha 24 : Kolkata – Union Home Minister Amit Shah on Monday said that the…