Advancing Cashless India

₹1,500 Cr Incentive Scheme for Low-Value BHIM-UPI Transactions

| The Union Cabinet has approved a ₹1,500 crore incentive scheme for FY 2024–25 to promote low-value BHIM-UPI (P2M) transactions and encourage digital payments among small merchants. The scheme ensures zero MDR on UPI transactions and offers a 0.15% incentive for transactions up to ₹2,000 made to small merchants. The scheme aims to expand UPI infrastructure across rural and semi-urban areas through tools like UPI 123PAY, Lite, and LiteX. According to the ACI Worldwide Report 2024, India contributed 49% of all global real-time transactions in 2023 — reaffirming its position as a global leader in digital payment innovation. |

The Union Cabinet, chaired by Prime Minister Shri Narendra Modi, has approved the ‘Incentive Scheme for Promotion of Low-Value BHIM-UPI Transactions (Person to Merchant – P2M)’ for the financial year 2024-25. This step supports the Government’s goal of boosting digital payments, encouraging small merchants to adopt UPI, and promoting financial inclusion.

Strengthening India’s Digital Payment Ecosystem

Promotion of digital payments is an integral part of the Government’s strategy for financial inclusion and providing wide-ranging payment options to the common man.

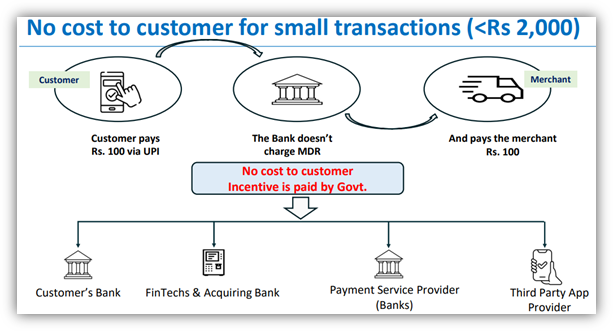

The expenditure incurred by the digital payment industry for providing services to customers/merchants is recovered through the Merchant Discount Rate (MDR). The merchant discount rate (MDR) is a fee that merchants and other businesses must pay to a payment processing company on debit or credit card transactions. The MDR typically comes in the form of a percentage of the transaction amount.

As per RBI, MDR of up to 0.90% of the transaction value is applicable across all card networks for debit cards. As per NPCI, MDR of up to 0.30% is applicable for UPI P2M (Person to Merchant) transactions. Since January 2020, to promote digital transactions, MDR has been made zero for RuPay Debit Card and BHIM-UPI transactions through amendments in Section 10A of the Payments and Settlement Systems Act, 2007 and Section 269SU of the Income-tax Act, 1961.

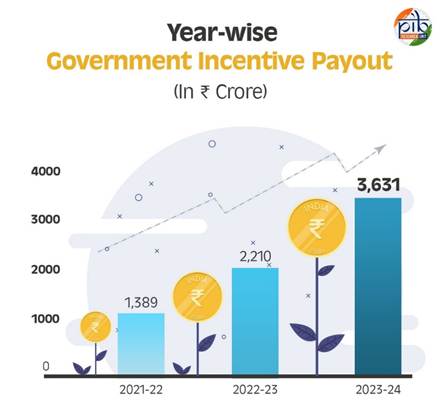

To support payment ecosystem participants in effective service delivery, the Government has implemented the “Incentive scheme for promotion of RuPay Debit Cards and low-value BHIM-UPI transactions (P2M)”, with due Cabinet approval. The incentive is paid by the Government to the Acquiring Bank (merchant’s bank) and is then shared among other stakeholders: Issuer Bank (customer’s bank), Payment Service Provider Bank (facilitates UPI onboarding/API integration), and App Providers (TPAPs). Year-wise incentive payout by the Government (in Rs. crore) during the last three financial years:

Scheme overview

The incentive scheme for promotion of low-value BHIM-UPI transactions (P2M) will be implemented at an estimated outlay of Rs 1,500 crore, from 1st April 2024 to 31st March 2025. It exclusively covers UPI (Person to Merchant – P2M) transactions of up to ₹2,000, specifically targeting small merchants to encourage the adoption of digital payments at the grassroots level.

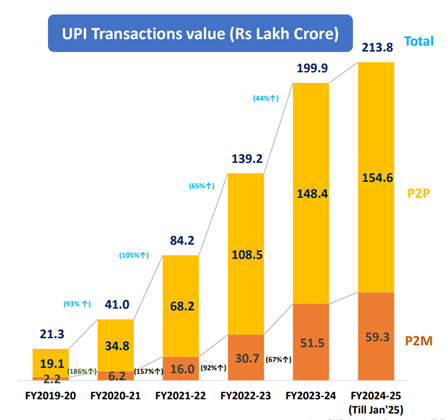

UPI transactions have seen a significant surge in recent years, with total transaction value rising from ₹21.3 lakh crore in FY2019-20 to ₹213.8 lakh crore till January 2025. Of this, Person to Merchant (P2M) transactions have grown steadily, reaching ₹59.3 lakh crore, reflecting increased digital payment adoption among merchants.

P2P-Person to Person, P2M-Person to merchants

Scheme objectives

- Promote BHIM-UPI Platform: Aim to reach ₹20,000 crore in transaction volume during FY 2024-25.

- Strengthen Payment Infrastructure: Support participants in building secure digital payment systems.

- Ensure Reliability: Maintain high uptime and reduce technical declines.

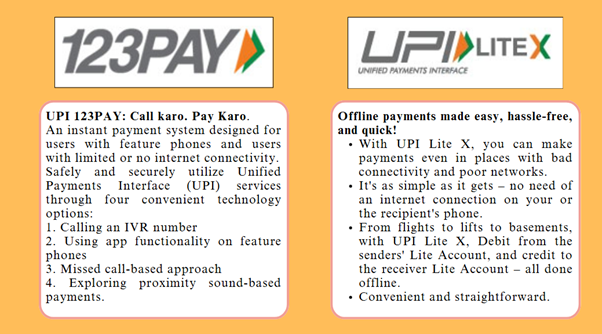

- Rural Penetration: Expand UPI services in tier 3 to 6 cities and remote areas using:

- UPI 123PAY (for feature phones)

- UPI Lite and UPI LiteX (for offline payments)

Incentive Structure

Under the approved scheme, incentives are designed based on the merchant category and transaction value. For small merchants, UPI transactions up to ₹2,000 will attract zero Merchant Discount Rate (MDR) and will be eligible for an incentive of 0.15% of the transaction value. For transactions above ₹2,000, there will be zero MDR but no incentive. In the case of large merchants, all transactions—regardless of the amount—will have zero MDR and will not carry any incentive.

Reimbursement mechanism

- 80% of the admitted claim amount by the acquiring banks will be disbursed unconditionally each quarter.

- Remaining 20% will be disbursed based on the following performance criteria:

- 10% of the admitted claim will be paid only if the acquiring bank’s technical decline rate (failed transactions due to technical issues on their side) is less than 0.75%.

- The remaining 10% of the admitted claim will be paid only if the acquiring bank’s system uptime (availability of their systems) is more than 99.5%.

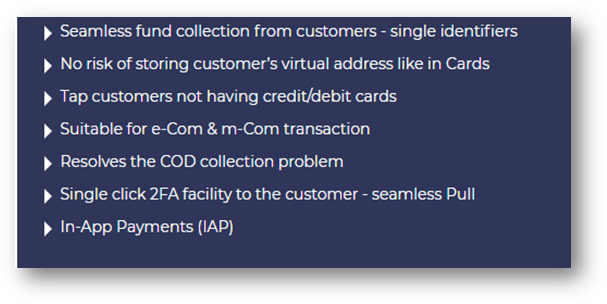

UPI – Benefits to merchants

Key benefits of scheme

- Convenience & Speed: Seamless, secure, and fast payments improve cash flow and provide digital credit access.

- No Extra Charges: Citizens can pay digitally without any additional fees.

- Support for Small Merchants: Encourages cost-sensitive merchants to accept UPI payments.

- Less-Cash Economy: Promotes formal, accountable digital transactions.

- System Efficiency: High uptime and low failure rate conditions ensure reliable 24×7 payment services.

- Balanced Approach: Encourages digital growth while managing Government expenditure prudently.

Unique features of BHIM-UPI

| Instant Transfers: Round-the-clock money transfer via mobile devices, all 365 days. |

| Unified Access: One mobile app to access multiple bank accounts. |

| Single Click 2FA: Strong, seamless two-factor authentication. |

| Virtual Addresses: Enhanced security—no need to enter card or bank details. |

| QR Code Payments: Easy scan-and-pay experience. |

| Versatile Use: Suitable for in-app purchases, utility bills, donations, collections, and more. |

| Direct Complaint Handling: Users can raise issues via the mobile app itself. |

UPI’s Global Expansion

India’s digital payments movement is gaining global attention, with UPI and RuPay expanding across borders. UPI is now operational in seven countries:

UAE, Singapore, Bhutan, Nepal, Sri Lanka, France, and Mauritius.

- France marks UPI’s debut in Europe, allowing smooth payments for Indians abroad.

- UPI is also being promoted within the BRICS group, enhancing remittances, financial inclusion, and global recognition.

- As per the ACI Worldwide Report 2024, India accounted for 49% of all global real-time transactions in 2023 underscoring India’s leadership in digital payment innovation.

Towards an inclusive digital economy

The approved incentive scheme for FY 2024-25 marks a major step forward in India’s digital journey. It not only supports the use of BHIM-UPI among small merchants but also strengthens the country’s financial infrastructure. With UPI leading globally, India continues to set benchmarks in innovation, inclusion, and secure digital payments. Through this initiative, the Government aims to ensure that businesses of all sizes—especially at the grassroots—can benefit from seamless, secure, and cost-effective cashless transactions.

Rutherford’s Power-Hitting Lifts West Indies to 196/6 After Early Collapse Against England

Mumbai, Feb 2026 : Sherfane Rutherford produced a breathtaking display of power and compos…