Beijing’s dominance in the Critical Minerals is matching up to Washington’s lead in Artificial Intelligence.

While the United States tried to deescalate Chinese AI progress with export bans, a tactic which China later employed to regain some ground. Rare earths are needed for everything from consumer electronics to electric vehicles, wind turbines and fighter jets – and China controls the supply chain. Beijing’s dominance in the critical minerals is matching up to Washington’s lead in artificial intelligence, which reiterates that they are inter related.

When the US president unveiled his tariffs in April, China knew it had a trump card that had been quietly gaining in value over the decades and that no other country in the world held. As the threatened tariffs rose, Beijing announced that it was imposing export controls on seven rare earth elements and magnets.

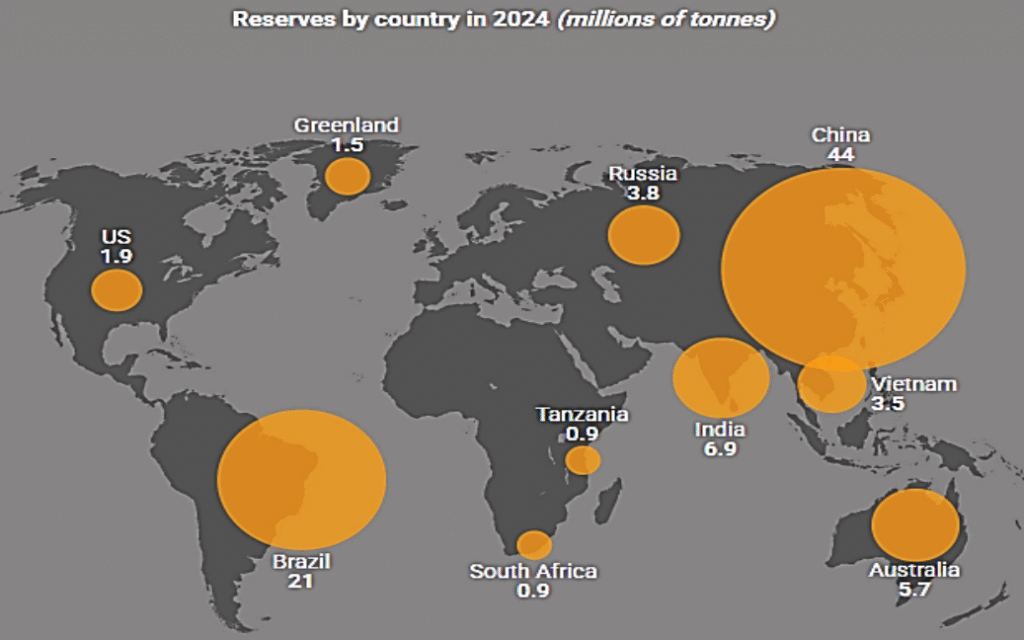

Rare earths are essential components in many technologies, from consumer electronics and electric vehicles, through clean energy and aerospace, to medical and defence equipment. They are also used in research and development, including semiconductors. China is blessed to possess half of the world’s reserves of rare earths and most of the global refining capacity. And from 2020 to 2023, 70% of rare earth compounds and metals imported by the United States were from China, according to the US Geological Survey.

By some US estimates, limits on access to these minerals could affect nearly 78% of all Pentagon weapons systems. The minerals have now become a central element of the US-China trade war, becoming leverage not only in reducing Washington’s tariffs but also in challenging American efforts to maintain its dominance in another area of intense rivalry – artificial intelligence chip technology.

The US has been trying to slow China’s AI progress by limiting its access to advanced chips since late 2022 – a strategy that has hindered broad adoption of the technology by Chinese enterprises, as without chips, China could find it hard to overcome the so-called scaling law in AI, a principle espoused by many developers that asserts the larger the training data and model parameters, the stronger the model’s eventual intelligence. Among the chips on the banned list are US manufacturer Nvidia’s most advanced graphic processing units – products that can handle the highest demands of AI processing.

The rare earth ban forced the United States to the negotiating table. Although the United States had resumed selling Nvidia’s H20 chip, to the Chinese market – a decision announced by CEO Jensen Huang last month during his third visit to China this year, which is Nvidia’s “fourth best” processor and “we want to keep China using it”. (fourth best refers to the fourth grade)

Analysts said the developments underscored the significance of rare earths in the US and China’s geopolitical tug of war. Technological dependencies – on these materials as well as AI and scientific talent – would remain strategic choke points, they warned.

Since China dominates rare earth processing technology, especially for heavy rare earths, the export controls highlight the ex-China market’s dependence, prompting governments to increase financial support for technology development; when it is clear that Trump wants to make a deal, but it is in Beijing’s best interest to drag out negotiations, allowing China to continue to catch up technologically to the US in key areas, such as quantum, AI and advanced computing and communications.

China’s massive science and engineering talent pool – which historically has looked to the US for education and research careers – could also become another potential lever for Beijing to exert pressure on the US, if they want to cede scientific leadership to China. The implications of export controls by the US, as a policy lever to compete with China, had accelerated China’s goal of indigenising its chipmaking production supply chain. Today, Chips developed by tech giant Huawei were expected to match performance with Nvidia’s advanced product at a lower cost, while Chinese companies were innovating differently as well as deploying less-efficient chips more effectively. Recognising that, to achieve its goals in domains such as AI, China must overcome a chip -deficient environment and quicken its drive for self-sufficiency across the semiconductor supply chain.

More than US$1.25 billion in capital investment announcements have been made globally since April, reflecting strong support for technological advancement, 91% of investments in mining, refining, magnet manufacturing and recycling of rare earths came from government-backed consortiums, with the US in the lead at US$570 million in total announcements.

There has been a noticeable global surge in strategic consolidations, spanning acquisitions, mergers, joint ventures, and technology partnerships to speed up the development of the supply chain, which further reiterated with Apple’s commitment to buy US$500 million of “American-made rare earth magnets” from MP Materials.

Globally, efforts are under way to build and diversify more resilient and sustainable rare earth supply chains, but would contribute to further decoupling in science and technology, especially if the Donald Trump’s administration continues its aggressive posture on immigration and enforcement.

Team Maverick

Abhishek Sharma Fit to Face Pakistan as Suryakumar Yadav Plays Down Pressure Ahead of Big Clash

Colombo, Feb 2026 : India captain Suryakumar Yadav on Saturday confirmed that young opener…