Gold Market Dynamics in 2025 Has Transformed Due To Revolutionary Changes.

The current paradigm shift in gold market dynamics represents a fundamental break from established market conditions where previous assumptions no longer apply. Furthermore, understanding these transitions requires examining the fundamental economic forces that drive structural changes across decades-long cycles. A paradigm shift represents a fundamental break from established market conditions where previous assumptions no longer apply. Academic research identifies four primary indicators of such transitions:

Monetary regime changes occur when central bank policies fundamentally alter the relationship between interest rates, inflation expectations, and currency valuations. The collapse of the Bretton Woods system in 1971 exemplifies this type of transition, ending the gold standard era that had fixed exchange rates for 27 years.

Institutional behaviour reversals manifest when large-scale capital allocators modify their strategic positioning. Central banks purchased 1,037 tonnes of gold in 2023, the highest level since 1967, representing a 38% increase from 2022 levels according to World Gold Council data.

Multi-decade trend breaks signal the end of 20-40 year economic cycles through technical breakouts in key ratios and price levels. These patterns, when confirmed on logarithmic scale charts, often precede sustained shifts in asset class leadership.

Cross-asset performance inversions emerge when traditional correlations between stocks, bonds, and commodities fundamentally reverse. Consequently, this creates new risk-return dynamics across portfolios.

Economic history reveals distinct eras characterised by different monetary frameworks and asset performance patterns:

- 1930s-1970s: The controlled monetary system under Bretton Woods featured fixed exchange rates and gold convertibility at $35 per ounce

- 1970s-1980s: Inflationary breakout period saw gold rise from $35 to $850 (2,328% increase), while S&P 500 delivered only 47% nominal returns during the decade

- 1980s-2020s: Disinflationary environment enabled financial asset dominance, with S&P 500 gaining 460% from 1980-2000 while gold declined 68%

- 2020s-Present: Emerging fiscal dominance creates conditions favouring real assets amid unprecedented debt expansion and monetary policy constraints

Central Banking Institutions worldwide are fundamentally altering their reserve composition strategies, driven by concerns over currency concentration risk and geopolitical stability. This institutional shift creates structural demand patterns that differ markedly from historical precedents, contributing to the current all-time high gold prices.

While complete de-dollarisation remains structurally complex, measurable shifts in reserve composition are occurring. Dollar-denominated reserves declined from 71% of global central bank holdings in 2000 to 59.5% by Q2 2024, according to IMF COFER data.

Central Bank Gold Accumulation Patterns (2020-2025)

The People’s Bank of China increased disclosed gold reserves from 1,948 tonnes in April 2022 to 2,191 tonnes by November 2024. This represents strategic accumulation during a period of yuan internationalisation efforts and reduced US Treasury holdings.

Sovereign wealth fund diversification increasingly favours natural resources and real assets. Research indicates average SWF allocation to this category increased from 8-12% in 2010 to 12-18% in 2023. However, specific gold allocation data remains limited due to disclosure constraints.

Regulatory framework changes under Basel III recognise gold as a zero-risk-weight asset for central banks. This permits its inclusion as highest-quality liquid assets for liquidity coverage ratios. However, this applies specifically to central banks rather than commercial banking institutions.

Insurance company reserve evolution varies significantly by jurisdiction. While European insurers operate under Solvency II regulations and US insurers follow state-based frameworks, neither uniformly favours gold allocation compared to traditional fixed-income securities.

Historical analysis reveals distinct periods of asset class leadership correlating with monetary and economic conditions:

Historical Gold vs. S&P 500 Performance Eras:

Historical analysis reveals that when 10-year Treasury yields exceed levels sustainable relative to government debt burdens, economies experience structural stress. This historically benefits real assets. The relationship between debt capacity and interest rate tolerance follows mathematical constraints.

Debt-to-GDP vs. Interest Rate Sustainability Matrix:

- 30-50% Debt/GDP: Historically sustained 10-15% interest rates (1940s-1950s period)

- 80-100% Debt/GDP: Maximum sustainable rates typically 4-6% without debt service stress

- 120%+ Debt/GDP: Creates structural pressure for yield suppression below 3%

Traditional market structure centred on London OTC markets and COMEX futures continues to influence global pricing. However, emerging alternatives are gaining significance:

Eastern physical markets in Shanghai, Dubai, and Mumbai increasingly trade at premiums to Western paper markets. This suggests geographic arbitrage opportunities and regional supply-demand imbalances.

Blockchain platforms enable tokenised gold ownership with molecular tracking systems. These create verifiable chain-of-custody records from mining through final ownership transfer.

Regional exchanges facilitate local settlement mechanisms that reduce dollar dependency in precious metals transactions. This is particularly relevant for emerging market participants seeking currency diversification.

Supply Chain Transparency Revolution:

- Molecular marking technology creates unique identifiers for gold quantities, enabling complete traceability throughout the supply chain. This technology addresses ESG compliance requirements and supports premium pricing for sustainably sourced metals.

- ESG compliance integration increasingly influences institutional gold purchasing decisions. Mining companies implementing environmental and social governance standards often achieve price premiums ranging from 2-5% above conventional sourcing.

- Digital ledger systems reduce settlement risk and improve liquidity by enabling faster transaction clearing. Furthermore, they reduce counterparty exposure through distributed verification networks.

Historical Correlation Analysis During Commodity Cycles

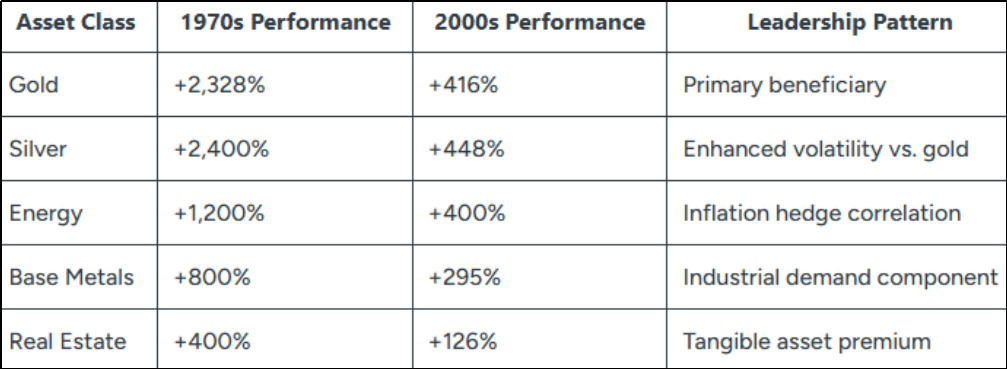

Asset Performance During Previous Gold Bull Markets

Defensive positioning strategies typically allocate 10-20% to precious metals during paradigm transition periods. This allocation provides portfolio insurance against currency debasement and financial system stress.

Inflation hedging approaches favour real assets over financial assets when debt-to-GDP levels exceed 100%. This is particularly relevant when real interest rates remain suppressed below historical averages.

Currency diversification becomes critical when single-currency exposure exceeds 60% of reserve holdings. This is evidenced by central bank behaviour patterns discussed previously.

Sector rotation timing follows predictable sequences during commodity cycles. Precious metals typically lead, followed by energy and industrial materials as inflation expectations broaden.

BRICS+ Monetary System Development:

Alternative settlement mechanisms continue developing through bilateral trade agreements that reduce dollar transaction requirements. While complete BRICS currency systems remain theoretical, incremental progress in payment systems creates structural changes.

Commodity-backed currency discussions within BRICS+ nations explore gold as potential backing for international trade settlement. However, implementation faces significant technical and political obstacles.

Trade finance evolution increasingly incorporates bilateral agreements that bypass traditional Western banking systems. This particularly follows 2022 sanctions precedents that highlighted reserve asset vulnerability.

Generational Wealth Preservation Strategies:

Multi-decade holding periods align with historical precedents showing that paradigm shifts typically persist for 10-20 year cycles. Investors positioning for current transitions should prepare for extended timeframes rather than short-term speculation.

Inheritance planning incorporating physical assets requires consideration of storage, insurance, and transfer mechanisms that preserve value across generations. This maintains liquidity access when needed.

Currency debasement protection becomes increasingly relevant as global debt-to-GDP ratios reach historical extremes. Real purchasing power preservation may require allocation to assets that maintain value independent of fiat currency systems.

Crisis insurance through precious metals allocation provides portfolio stability during financial system stress. However, such positions should complement rather than replace diversified investment strategies.

Economic Scenario Planning:

High inflation environment: Gold historically preserves purchasing power during periods of currency debasement. However, performance varies depending on real interest rate levels and fiscal policy responses.

Deflationary spiral: Safe haven demand during credit contractions can support gold prices even in deflationary environments. This is particularly true when confidence in financial institutions diminishes.

Currency crisis: Alternative store of value demand increases during periods of competitive debasement or loss of reserve currency confidence. However, such scenarios involve significant economic disruption.

Geopolitical instability: Neutral asset characteristics make gold attractive during international tensions. However, political risk affects all asset classes during severe conflicts.

“This analysis presents educational information about historical market patterns and economic relationships. Past performance does not guarantee future results, and

precious metals investments involve risk including potential loss of principal”.

Team Maverick

Rutherford’s Power-Hitting Lifts West Indies to 196/6 After Early Collapse Against England

Mumbai, Feb 2026 : Sherfane Rutherford produced a breathtaking display of power and compos…