Economic Protests In Iran On December 29, And Its Aftereffects.

Tehran; December 2025: Small-scale protests demanding that the Iranian government address the devaluation of the Iranian rial and high inflation rates have continued for the second consecutive day in Tehran and Hamadan City, western Iran, on December 29, amid rapid collapse of the Iranian currency since November 2025.

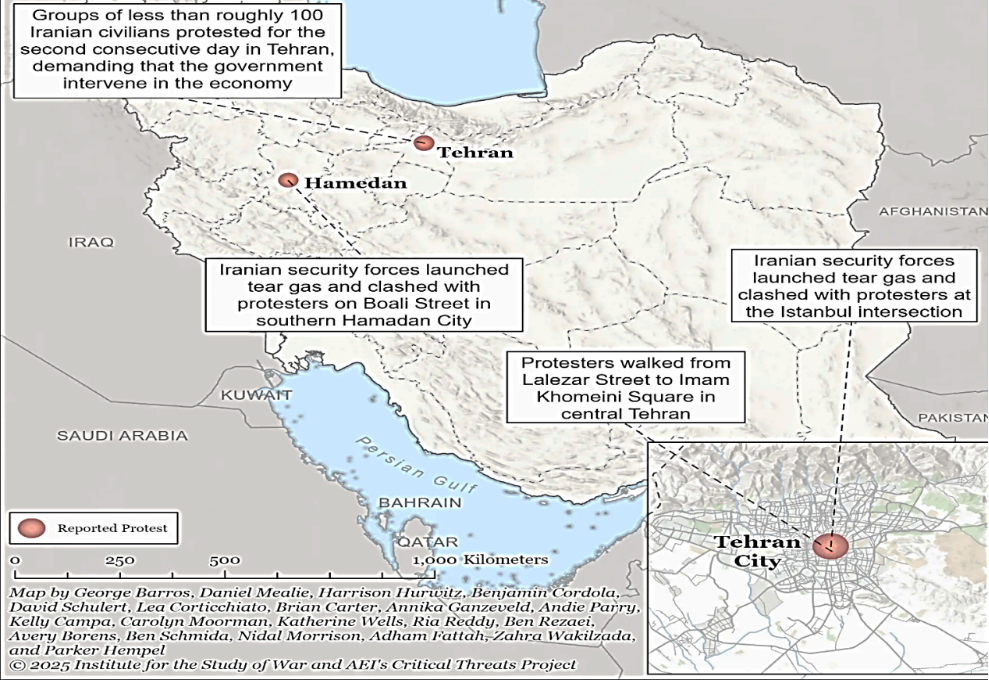

The value of the Iranian rial has deteriorated rapidly after November 2025, though its value has fallen for years due to sanctions and Iran’s general international isolation. Protests initially began in Tehran on December 28th when group of less than roughly 100 civilians, who were reportedly Iranian businessmen, marched from Lalezar Street toward the Imam Khomeini Square on December 29th, demanding that the Iranian government intervene in the economy and address the high inflation rate and devaluation of the currency.

Iranian security forces halted and clashed with the protesters at the Istanbul intersection on December 29th, according to Islamic Revolutionary Guards Corps (IRGC)-affiliated media and geolocated footage. Iranian security forces also launched tear gas and clashed with protesters on Boali Street in southern Hamedan City on December 29th.

According to a Persian journalist who has reported that economic protests also occurred in Malard City, Tehran Province, and on Gheshm Island in the Persian Gulf, but did not provide footage of the protests at the time of this writing. Tehran merchants announced that they will continue to protest on December 30th. The protests come amid a drop in the value of the Iranian rial. The value of the Iranian rial reached 1,445,000 rials per one US dollar as of December 28, which marks its lowest value in 2025. The rial however appreciated slightly to 1,371,000 rials to one US dollar on December 29th.

Current economic-related protests come as the Iranian regime is deliberating on Iran’s 2026/27 budget, which is set to increase taxes to relieve Iran’s budget deficit as state oil revenue decreases, but will put additional economic pressure on the Iranian people.

Iranian President Masoud Pezeshkian have defended his proposed budget in front of the Iranian Parliament’s budget oversight committee on December 28, in which Pezeshkian proposed a tax increase by 62%. This increase in the tax rate will worsen the economic challenges caused by inflation that are plaguing Iranians. Iranian media representatives on December 28th and 29th have criticised the budget for not adjusting salaries in accordance with the current 42.2% percent inflation rate.

The proposed 2025 budget reportedly reflects a decrease in dependency on oil revenue. Iranian oil revenue, its main source of government revenue has dropped significantly, only meeting about 16% of the expected annual revenue in 2025, according to the parliamentary Budget and Planning Commission Deputy Chairman on November 06th. The parliament’s budget oversight committee rejected Pezeshkian’s proposed 1405 March 2026 to March 2027 budget on December 29th and is set to provide feedback to Pezeshkian’s cabinet on December 30th.

Iranian regime-affiliated media recognized the protesters’ grievances as legitimate but warned that these protests could escalate into “unrest” or be exploited by Iran’s adversaries. “Unrest” in this context presumably refers to anti-regime protests specifically, rather than protests over economic grievances.

IRGC-affiliated media acknowledged that Iranian merchants have been unable to pay rent for their shops due to the increase in the prices of imports and basic goods and drop in their sales, and even called on the government to take these economic protests seriously. The IRGC published an official statement on December 29th, calling on the Iranian people to stay united amid the United States and Israel’s efforts to undermine public trust and conduct “cognitive warfare”.

The regime’s anxieties over these protests spiraling out of control and escalating into anti-regime protests are valid because previous economic protests have escalated into nationwide anti-regime protests in 2017 and 2018.

Iranian regime-affiliated outlets also warned that these could be exploited by Iranian adversaries, namely Israel. The Iranian regime has repeatedly blamed Israel and the United States for anti-regime protests over the past decade.

Mostafa Najafi, a political advisor close to former IRGC Commander and Expediency Discernment Council member Mohsen Rezaei, separately assessed on December 29 that Israel could exploit Iran’s weakened position and attack Iran, and added that Israel could even convince the United States to attack Iran as well during Israeli Prime Minister Benjamin Netanyahu’s visit to the United States. Najafi noted that the Iranian regime needs to address external perceptions of internal unrest in Iran.

The Iranian regime’s attempts to address economic issues are unlikely to provide immediate relief to the economy, however. Pezeshkian replaced Iranian Central Bank Governor Mohammad Reza Farzin with former Economy Minister Abdol Nasser Hemmati on December 29, following pressure from “almost everyone in government”, according to Najafi.

Hemmati previously served as Central Bank governor during US President Donald Trump’s first round of maximum pressure between 2019 and 2021, when inflation rates increased from around 40% to 45% and the rial ‘s value more than halved.

Pezeshkian claimed that his budget involved a 20-point plan, which involved controlling energy consumption and relying on trade with regional partners to ensure people’s livelihoods, in an interview with the Supreme Leader’s official outlet on December 27th. Pezeshkian held an emergency meeting with the government’s economic team at the Central Bank on December 29th to discuss foreign exchange, trade, and livelihood policies after Parliament’s budget oversight committee rejected his budget proposal.

Meanwhile, 165 Irani Parliamentarians out of 290 Iranian parliamentarians separately signed a letter to Pezeshkian, Parliament Speaker Mohammad Bagher Ghalibaf, and Judiciary Chief Gholam Hossein Mohseni Ejei on December 25th, in which they expressed their concern over severe price and foreign exchange rate fluctuations. The letter presented five solutions to remove all competitor currencies to the rial from transactions (such as gold, cryptocurrencies, and foreign currencies) to strengthen the rial.

The Central Bank have previously proposed and may have recently implemented other mechanisms, including exporting transactions to a secondary market to encourage exporters to return foreign currencies faster and increase the foreign currency reserve to help stabilize the foreign exchange market. These mechanisms mean that, in theory, the Central Bank does not need to rely as much on building foreign reserves to control the exchange rate and subsequently inflation. It remains uncertain whether any of these mechanisms would work in practice, as it would require public trust in the rial to stabilise inflation and the government’s handling of the economy, which is currently lacking.

Team Maverick.

Varun Chakaravarthy’s Magic Spell Powers India to Record 93-Run Win Over Namibia

New Delhi, Feb 2026 : Defending champions India delivered a commanding performance to thra…