GST Council Decisions Bring Relief to Farmers and Common Citizens: Women & Child Development Minister Aditi Tatkare

Council cuts GST rates on agriculture, essentials, health, and insurance

New Delhi, Sept 2025 : In a major step to support the agriculture sector, the GST Council has reduced the GST on tractors from 18% to 5%, and slashed the tax rates on bio-pesticides, fertilizers, irrigation equipment, and agricultural machinery from 12% or 18% to just 5%. This will help increase farmers’ income while reducing the overall cost of farming. Women and Child Development Minister Aditi Tatkare said that these decisions, taken in the 56th GST Council meeting chaired by Union Finance Minister Nirmala Sitharaman, will not only boost agriculture but also accelerate the country’s economic progress. She added that the Maharashtra government is committed to ensuring their effective implementation.

Tatkare, who represented Maharashtra in the meeting, also emphasized the need for concrete measures to strengthen tax collection discipline and presented a strong case in the interest of the state. She noted that the historic decisions taken in Delhi will provide significant financial relief to farmers, small and medium enterprises, and ordinary citizens.

Boost for Agriculture

The Council’s decision to cut GST on tractors and farm machinery to 5% is seen as a game-changer for the agricultural sector. Additionally, reductions in tax on raw materials like nitric acid and ammonia used in fertilizer production, along with cuts on textiles and leather, are expected to strengthen both agriculture and the textile industry.

Tax Relief for Common Citizens

GST reductions on essential daily-use items such as soap, detergents, talcum powder, toothpaste, toothbrushes, ready-made garments, footwear, and cosmetics will bring direct relief to households, helping them save on daily expenses and improving living standards.

Healthcare and Insurance Boost

In a landmark move, the Council decided to make all individual health and life insurance services fully tax-free, making insurance more affordable and accessible. Further, GST on all medicines has been cut from 12% or 18% to 5%, with certain essential drugs being made completely tax-exempt—steps expected to make healthcare more affordable.

Support for Infrastructure and Automobile Industry

To encourage infrastructure development, GST on cement has been reduced from 28% to 18%. The tax on small passenger vehicles and goods transport vehicles has been fixed at 18%, while white goods like TVs and air conditioners will also now attract 18% GST. According to Tatkare, these measures will accelerate growth in the automobile and export sectors.

She concluded that the Council’s decisions will act as a catalyst for agriculture, healthcare, infrastructure, and the automobile industry, giving Maharashtra’s economy new momentum while raising the standard of living for the common citizen.

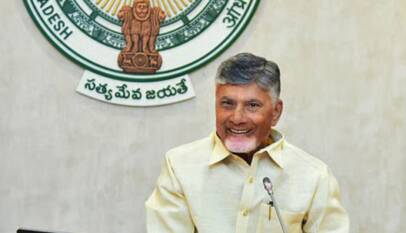

Naidu Urges NDA Legislators to Take Government Achievements to the People as Budget Session Begins

Amaravati, Feb 2026 : On the opening day of the Andhra Pradesh Legislative Assembly Budget…