Sale of ₹2,000 Crore Bonds by Maharashtra Government with 12- and 13-Year Maturity

Mumbai : The Maharashtra Government has announced the sale of ₹2,000 crore worth of government securities with a 12-year maturity period. These bonds will be issued under the terms and conditions specified in the revised notification of the government. The funds raised through this borrowing will be utilized to finance developmental projects, as per a statement issued by Finance Secretary Shaila A.

Under the revised non-competitive auction method, 10% of the total notified bond amount will be reserved for eligible individual and institutional investors. However, no single investor will be allotted more than 1% of the total notified amount.

The auction will be conducted by the Reserve Bank of India at its Mumbai office on April 29, 2025. Bids for the auction must be submitted through RBI’s electronic platform – the Core Banking Solution (e-Kuber) system – on the same date.

Competitive bids must be submitted between 10:30 AM and 11:30 AM, while non-competitive bids should be submitted between 10:30 AM and 11:00 AM through the e-Kuber system. The results of the auction will be published on RBI’s official website on the same day. Successful bidders must make the payment by April 30, 2025 via cash, banker’s cheque/payment order, demand draft, or a cheque payable at the RBI, Mumbai, before the close of banking hours.

The maturity period of the bonds is 12 years, starting from April 30, 2025, and repayment will be made at face value on April 30, 2037. The interest rate will be determined by the annual coupon rate established during the auction. Interest will be paid semi-annually on October 30 and April 30, starting from the bond’s original issue date.

Investments in these government bonds will qualify for Statutory Liquidity Ratio (SLR) purposes under Section 24 of the Banking Regulation Act, 1949. These bonds will also be eligible for re-trading.

Maharashtra Government Announces Sale of ₹2,000 Crore Bonds with 13-Year Maturity

Mumbai : Similarly, the Maharashtra Government will also sell ₹2,000 crore worth of government securities with a 13-year maturity period under the revised terms and conditions. The proceeds will again be used to support the state’s developmental initiatives.

Following the same revised non-competitive auction process, 10% of the notified bond amount will be allocated to eligible investors, with a cap of 1% of the total amount per investor.

The auction will take place on April 29, 2025, at the RBI’s Mumbai office, and bids must be submitted via the RBI’s e-Kuber platform.

Competitive bids can be placed between 10:30 AM and 11:30 AM, and non-competitive bids from 10:30 AM to 11:00 AM. The results will be announced on the RBI website the same day. Payments by successful bidders must be completed on April 30, 2025, through acceptable banking instruments or cheques payable at RBI, Mumbai.

The bond tenure will commence from April 30, 2025, and repayment will be made in full on April 30, 2038. Interest will be paid semi-annually on October 30 and April 30, at the coupon rate determined during the auction.

These bonds will also qualify as SLR-compliant under the Banking Regulation Act and will be eligible for re-sale and purchase in the secondary market, according to the Finance Department.

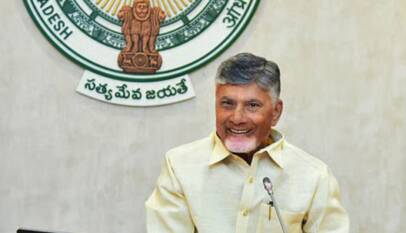

Naidu Urges NDA Legislators to Take Government Achievements to the People as Budget Session Begins

Amaravati, Feb 2026 : On the opening day of the Andhra Pradesh Legislative Assembly Budget…