As United States Withdraws From OECD Global Minimum Tax; Mexico Has Flagged Its Concern.

January 2026: The US decision to withdraw from OECD has widespread implications for taxation and competitiveness in attracting investment to the Mexican territory. The decision raises alarms for Mexico, as it has implications for taxation and competitiveness in attracting investment. Meanwhile, OECD estimates detail that the implementation of this global minimum tax has the potential to generate up to $200 billion in additional global tax revenue each year, a pool that Mexico can access and which is reduced after the US withdrawal.

The Donald Trump administration reached an agreement with the Organization for Economic Cooperation and Development (OECD) so that US companies will not have to pay the 15% global minimum tax in member countries, including Mexico. On his first day in office, Donald Trump signed an executive order to withdraw the US from the OECD countries’ plan to implement a 15% global minimum tax on transnational corporations, which aims to prevent capital flight to tax havens or low-tax jurisdictions, level the playing field for investments among member countries, and bring order to tax payments in the digital economy.

A year later, on 05th January 2026, US Treasury Secretary Scott Bessent reported that in coordination with Congress, work was done to reach an agreement with the more than 145 countries of the OECD / G20 Inclusive Framework so that companies based in this country would remain subject only to the US global minimum taxes, while being exempt from Pillar Two. “This joint agreement recognises the US fiscal sovereignty over the international operations of U.S. companies and the fiscal sovereignty of other countries over commercial activity within their own borders”.

The United States leads the world in outflows of investment, with $360 billion projected in 2024 alone, according to UNCTAD’s World Investment Report 2025. Furthermore, US companies account for the majority of Foreign Direct Investment (FDI) in Mexico. Figures from the Ministry of Economy show that they invested $16.146 billion between January and September of last year, representing 39.5% of total investment flows.

This has significant implications for the entire world, but particularly for Mexico, since the purpose of this minimum tax is to prevent base erosion (the use of strategies by multinationals to reduce their tax burden), and to try, as far as possible, to equalise or level the playing field regarding income and revenue generation in each of the countries, explained Jesús Guillermo Mendieta, spokesperson for the Tax Audit technical commission of the Mexican College of Public Accountants (CCPM), and partner at the firm Mendieta y Compañía. “It also impacts us because we depend on international tax cooperation for economic development, in our case, for our domestic economy”, commented the CCPM specialist.

In the recent context, the OECD and the G7 have pushed a scheme that has just been published called side by side, and this aims to address the position of the United States, seeking stability without necessarily dismantling the framework of pillar two, explained Montserrat Colin, President of the International Tax Commission of the Mexican Institute of Public Accountants (IMCP).

“That changes the map of who collects the top-up tax in certain cases, and forces Mexico to think, from my point of view, technically, whether it wants to collect it domestically or whether it wants to leave the collection to be exported to other jurisdictions. For Mexico, the main implication is applying a supplementary tax”, Colin explained.

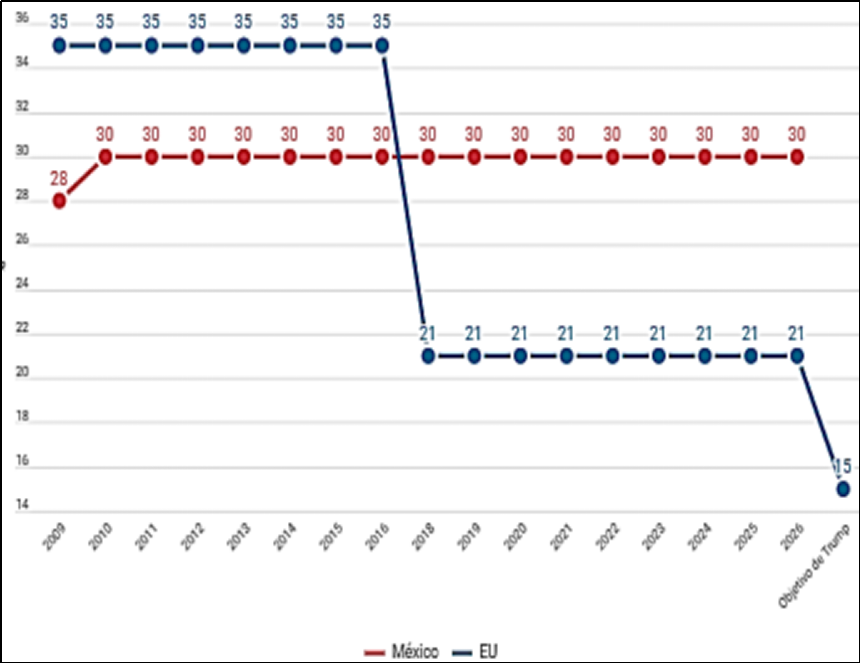

This withdrawal results in Lower taxes in the US. Among Trump’s promises is also reducing the corporate income tax rate (ISR, in Mexico) from 21% to 15%, and leaving the OECD agreement is one of the first steps to achieve this.

This would mean a disadvantage in terms of tax competitiveness; “you are practically giving more incentives for transnational companies to leave the US, because of a lower rate, right now it’s 21% there, while we have 30%. If we look at it in the long and medium term, what you’re going to say is, ‘better send your companies to the US and leave a representative office in Mexico’”, Mendieta commented.

However, companies consider various factors that affect their final costs, such as wage levels, geographic location, and local taxes (state and/or municipal), to decide whether to leave or move their investments to other destinations, experts agree.

“If you compare at the federal level, we are obviously higher, but considering local taxes, which vary from state to state, we are more homogeneous. Beyond that, Mexico remains moderately competitive. Beyond the tax aspect, it is a country with many advantages in terms of investment. Ultimately, one of its strongest points is its geographic location. You have the predictability that, despite everything, the USMCA continues to offer, the cheapest natural gas in the world coming from Texas, and a workforce that remains at competitive levels, even though labor costs have increased in recent years”, said Oscar Ocampo, Director of Economic Development at the Mexican Institute for Competitiveness (IMCO).

“It’s not necessarily a driver to, say, decrease the attractiveness of US investment in Mexico, but it could be a topic to take into consideration”, the IMCO specialist said.

Team Maverick.

Bangladesh Votes for Change as BNP Surges Ahead in Post-Hasina Election

Dhaka, Feb 2026 :Vote counting began in Bangladesh late Thursday after polling concluded f…