Adani Enterprises Ltd announces highest half-yearly EBIDTA in H1FY25 results

Consolidated EBIDTA increased by 47% to INR 8,654 crore

Consolidated PBT increased by 137% to INR 4,644 crore

Incubating Businesses EBIDTA up by 85% to INR 5,233 crore

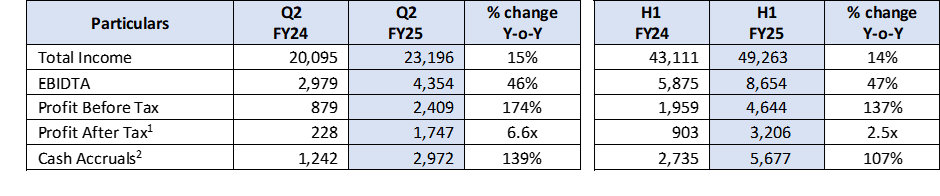

Consolidated financial highlights H1 FY25 (YoY)

- Revenue increased by 14% to INR 49,263 crore

- EBIDTA increased by 47% to INR 8,654 crore driven by continued strong operational performance by the Adani New Industries Ltd (ANIL) ecosystem and Airports

- PBT increased by 137% to INR 4,644 crore

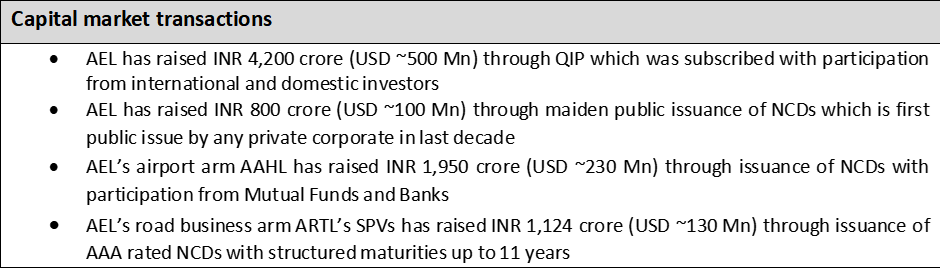

Capital market transactions

- AEL has raised INR 4,200 crore (USD ~500 Mn) through QIP which was subscribed with participation from international and domestic investors

- AEL and its subsidiaries have raised INR 3,874 crore (USD ~460 Mn) through issuances of NCDs which were subscribed by diversified set of investors

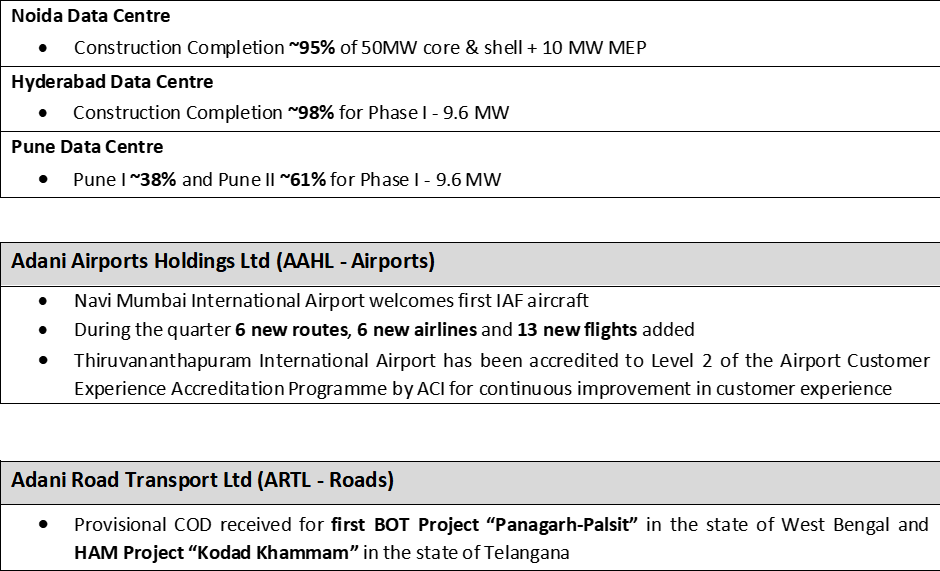

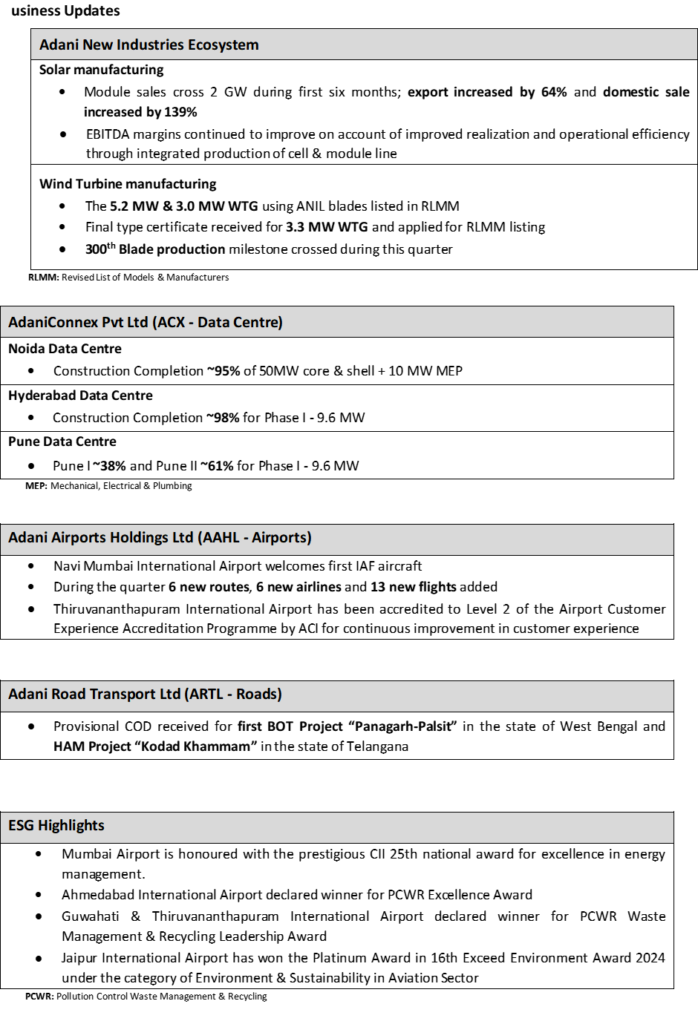

Business highlights

- Received Letter of Award for electrolyser manufacturing facility for 101.5 MW p.a. from SECI taking cumulative awarded capacity to 300 MW p.a.

- Navi Mumbai International Airport welcomes first IAF aircraft

- Provisional COD received for first BOT Project “Panagarh-Palsit” and HAM Project “Kodad Khammam”

- Letter of Award received for development & operation of Iron Ore mine at Taldih with capacity of 7 MTPA from SAIL

Ahmedabad : Adani Enterprises Ltd (AEL), the flagship company of the Adani Group, announced its results today for the quarter and half year ended 30 September 2024.

AEL’s constant endeavour on achieving operational efficiency across all business verticals along with incubating new asset base is reflected yet again in these results. AEL has recorded its highest half-yearly EBIDTA of INR 8,654 crore which is consistently supported by strong performance from emerging core infra businesses under its incubation portfolio. The emerging core infra businesses has recorded half-yearly EBIDTA of INR 5,233 crore with an increase of 85% on year-on-year basis on back of robust operational performance.

“Adani Enterprises Ltd (AEL) continues to focus on investing in logistics, energy transition and adjacent sectors that are core to the economic growth of the country. This record-breaking half-year performance has been led by Adani New Industries Ltd (ANIL) and Adani Airport Holdings Ltd (AAHL) with their rapid growth in capacity additions and asset utilisation,” said Mr Gautam Adani, Chairman of the Adani Group. “Our focus on execution of greenfield projects in ANIL across three giga scale integrated manufacturing plants and the accelerated development of Navi Mumbai International Airport are driving these robust results. Further, AEL is poised to repeat this turbo growth across data centres, roads, metals & materials and specialized manufacturing. AEL continues to invest in innovative technology across its platforms to support this high growth phase.”

Consolidated Financial Highlights

Note: 1. PAT attributable to owners 2. Cash Accruals is equal to Profit Before Tax + Depreciation – Current Taxes

Incubating Businesses Financial Highlights

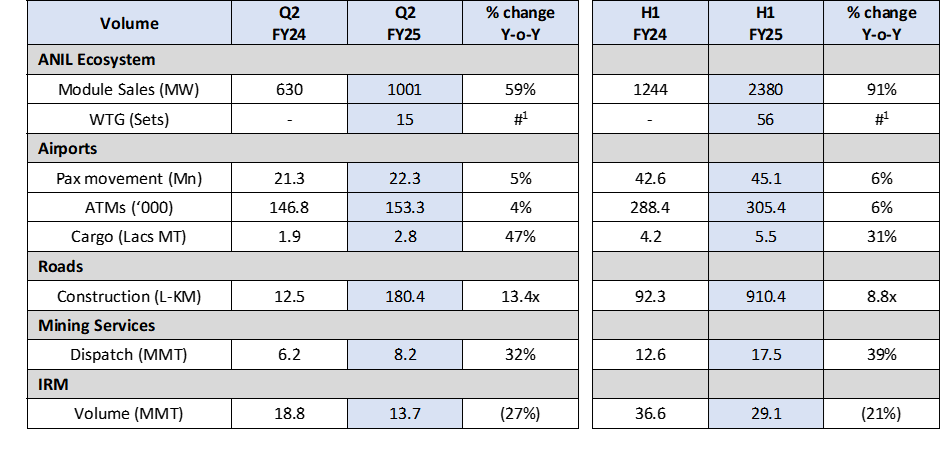

Operational Highlights

#1 Commercial production and supply of WTG sets started from Q3 FY24

About Adani Enterprises Ltd

Adani Enterprises Limited (AEL) is the flagship company of Adani Group, one of India’s largest business organisations. Over the years, Adani Enterprises has focused on building emerging infrastructure businesses, contributing to nation-building and divesting them into separate listed entities. Having successfully built sizeable and scalable businesses like Adani Ports & SEZ, Adani Energy Solutions, Adani Power, Adani Green Energy, Adani Total Gas and Adani Wilmar, the company has contributed to make India self-reliant with our robust businesses. This has also led to significant returns to our shareholders for three decades.

The next generation of its strategic business investments are centered around green hydrogen ecosystem, airport management, data centre, roads and primary industries like copper and petrochem – all of which have significant scope for value unlocking.

For more information, please visit www.adanienterprises.com

| Manan Vakharia |

| Adani Enterprises Ltd Investor Relations |

| Tel: +91-79-25556140 |

| mananj.vakharia@adani.com |

For more information please contact:

| Roy Paul |

| Adani Group, Corporate Communication |

| Tel: +91-79-25556628 |

| roy.paul@adani.com |

Former India Pacer Prasad Elected KSCA President, Ushers in New Leadership Era After Turbulent Year

Bengaluru, Dec 2025 : Former India fast bowler and national selector Prasad was on Sunday …